CTV ad market: streaming ads on the rise, but traditional TV still rules

The connected TV (CTV) advertising landscape is in the midst of a transformation. As more viewers flock to streaming platforms, ad dollars are gradually following suit. However, despite the growth in streaming, traditional television services—pay TV and broadcast—remain dominant. Data from Comscore’s Q2 2024 total CTV ad time reveals that while streamers are carving out a significant portion of the market, the lion’s share of advertising still resides with legacy TV services.

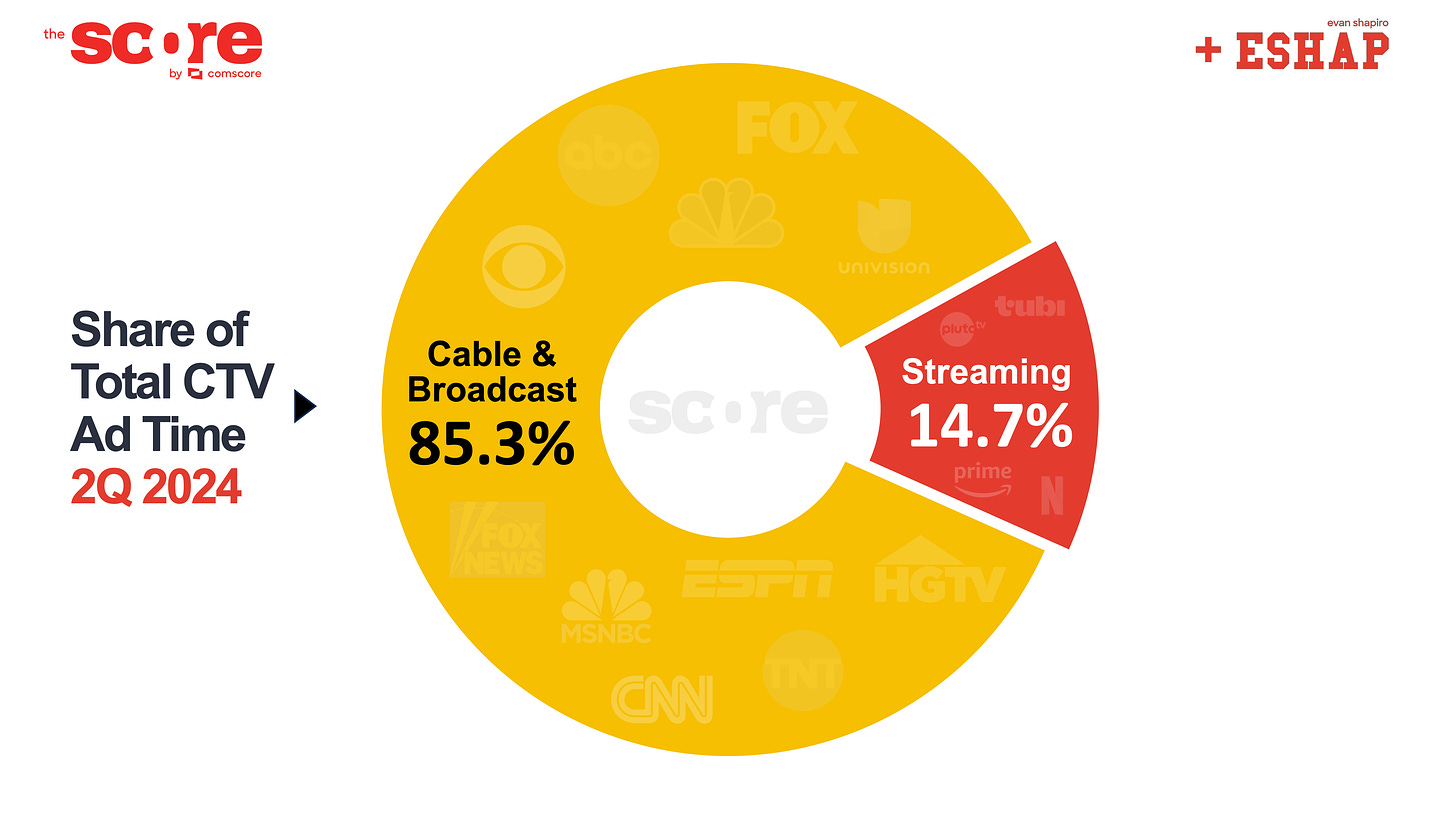

In the second quarter of 2024, 85.3% of TV ads were viewed on traditional pay TV and broadcast networks. Streaming services, which include the likes of Disney’s Hulu, YouTube, and Fox’s Tubi, accounted for 14.7% of TV ad views. While this may seem small in comparison, it’s a testament to the rising influence of streaming platforms in the advertising ecosystem.

Evan Shapiro, who partnered with Comscore on the report, emphasized this point, stating, “Despite tremendous audience migration in the last decade, traditional television services continue to retain much of television’s ad-supported viewing and therefore demand much more of TV’s advertising dollars.” This enduring dominance is a key insight as the industry navigates a balance between traditional and digital platforms.

Hulu dominates in the streaming ad space

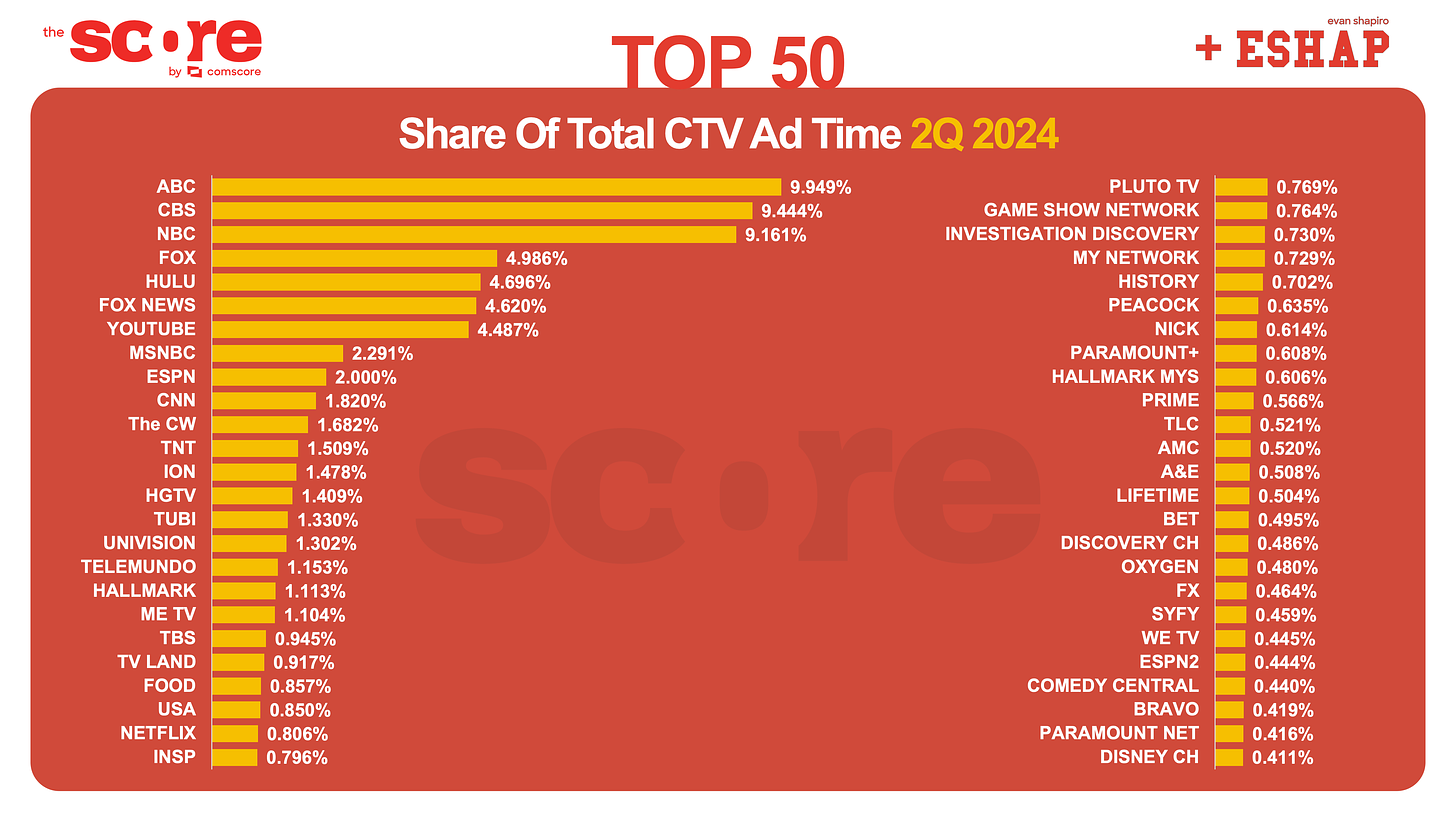

When we break down the streaming ad landscape, Hulu, YouTube, and Tubi emerge as leaders. Hulu, owned by Disney, holds a 4.69% market share of the total CTV ad space, placing it at number five overall. In comparison, YouTube, which is owned by Google, comes close with 4.48%, and Tubi, Fox’s free ad-supported service, holds a more modest 1.33%.

What’s particularly striking is Hulu’s performance relative to other giants in the streaming world. Despite having 33 million fewer U.S. subscribers than Netflix, Hulu reportedly averages six times more ad views than Netflix. This highlights the effectiveness of Hulu’s ad-supported model, especially in contrast to Netflix, which has yet to capitalize on ad revenue in a significant way.

Amazon’s Prime Video, which introduced a default ad tier in January 2024, has had a slower start in capturing ad dollars. By the end of the second quarter, Prime Video accounted for just 0.57% of the total CTV ad time. However, as Amazon ramps up its advertising offerings, this figure is expected to grow in the coming quarters.

Disney’s total ad power

Hulu’s success in the CTV ad market is further amplified by Disney’s broader advertising footprint. When factoring in ABC, Hulu, and ESPN, Disney commands more than 20% of the total TV ad market—the highest share of any media company. This dominance underscores the continued strength of Disney’s multi-platform strategy, which leverages its vast content library across traditional and digital platforms.

Shapiro added, “The Score employs Comscore’s BIG DATA: a combo of Comscore TV, Connected TV Intelligence, and Smart TV information from 22 million US households. This allows us to generate a unified view of TV ad exposure, across Pay TV, Broadcast, and Streaming, nationally and at the market level.” This unified view reveals just how significant legacy TV services still are in the advertising landscape.

As Shapiro notes, traditional TV still demands a large share of advertising dollars due to its established audience but as the landscape evolves, media companies that successfully integrate both streaming and traditional platforms into their advertising strategies—like Disney—are likely to emerge as the biggest winners.

À lire plus tard

Vous devez être inscrit pour ajouter cet article à votre liste de lecture

S'inscrire Déjà inscrit ? Connectez-vous