Bronfman sweetens bid for National Amusements, Paramount Stake

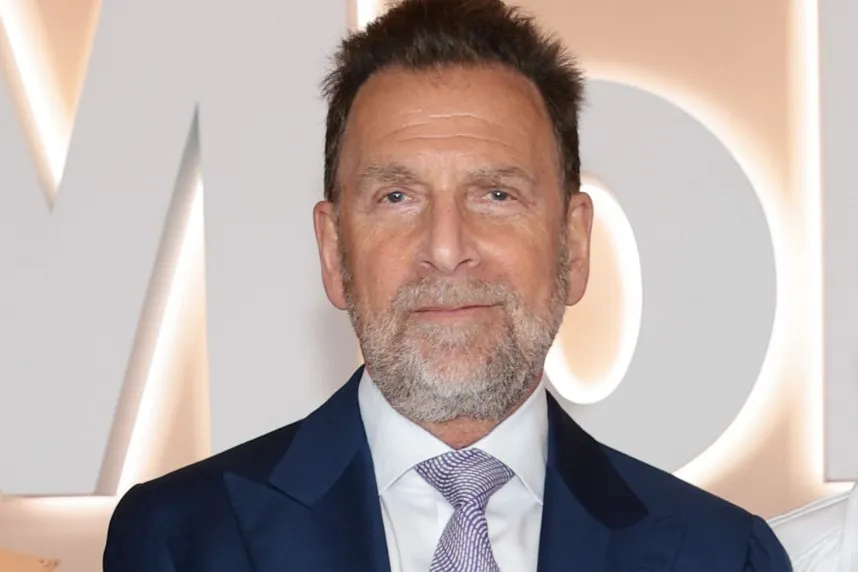

The battle for Shari Redstone’s media empire continues to heat up. Edgar Bronfman Jr. has significantly upped his offer for National Amusements and a minority stake in Paramount to $6 billion, a move that could derail Redstone’s planned sale to David Ellison’s Skydance Media.

“Go-shop” period extended to September 5

Bronfman, who earlier this week submitted a $4.3 billion bid, revised his offer hours before the deadline was set to expire Wednesday afternoon. In response, Paramount’s special committee has extended the “go-shop” period to September 5, allowing it to consider superior offers like Bronfman’s, the committee said in a statement. “There can be no assurance this process will result in a Superior Proposal. The Company does not intend to disclose further developments unless and until it determines such disclosure is appropriate or is otherwise required.”

Bronfman’s new proposal includes an additional $1.7 billion equity commitment, bringing the total to $3.2 billion. According to Axios, this additional funding can be used to either fund a cash tender for Class B at $16 per share or to strengthen Paramount’s balance sheet, a decision that will be negotiated with Paramount’s special committee.

‘Better deal for shareholders’

The Skydance buying consortium, which also includes private equity firms RedBird Capital Partners and KKR, agreed to invest more than $8 billion into Paramount and to acquire National Amusements. Although smaller, Bronfman argues his bid offers shareholders a better deal because their ownership wouldn’t be diluted as much.

Paramount’s special committee must now decide whether Bronfman’s offer trumps Ellison’s.

À lire plus tard

Vous devez être inscrit pour ajouter cet article à votre liste de lecture

S'inscrire Déjà inscrit ? Connectez-vous