Streaming wars shift gears: profitability takes center stage (NYT)

The golden age of streaming with cheap subscriptions and endless prestige TV may be over, according to the New York Times, who interviewed some of the industry’s big names, including Netflix co-CEO Ted Sarandos, Amazon’s Prime Video head Mike Hopkins, and IAC chairman Barry Diller. The executives explained that they are bracing for a new era – one focused on profitability, leading to a future that may feel similar to cable TV.

Shift towards profitability

Streaming giants like Netflix, Amazon Prime Video, and Disney+ are facing a reality check. User growth is slowing and major players are looking to consolidate. Now, the focus is on profitability, rather than growth-at-all-costs, and according to the industry leaders, the changes coming our way reflect this shift. Here are some of their predictions:

Price hikes and more ads

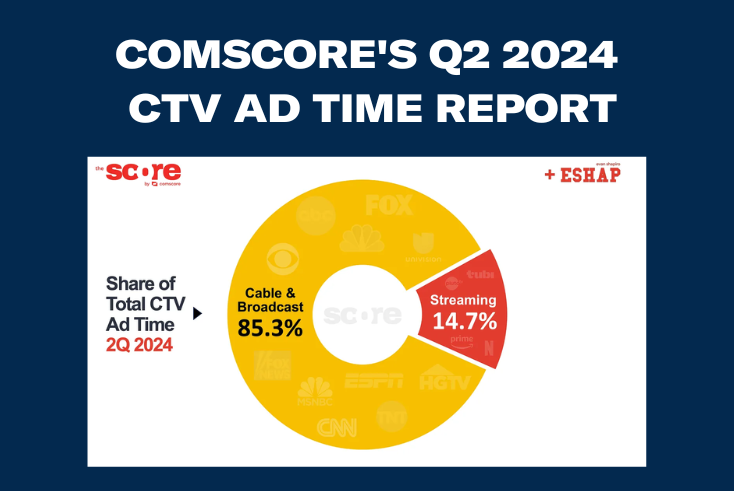

Prepare to see more commercials interrupting your favorite shows. Ad-supported tiers are becoming the norm, with companies hoping to nudge viewers towards these cheaper options. Some executives told the New York Times that streamers will keep raising prices for the ad-free tiers with the aim of pushing more customers to sign up for ad-supported subscriptions instead. This, in turn, could influence the type of content produced, potentially leading to a surge of “safe” shows designed to appeal to a broad audience – think cop dramas – reminiscent of network television.

Content: from prestige to mass appeal

However, executives assure us that prestige TV isn’t dead yet. They claim to be striking a balance, aiming for “prestige TV at scale” alongside crowd-pleasing content. For instance, Mike Hopkins, Amazon’s Prime Video head, told the NYT that at Prime Video, “procedurals and other tried and true formats do well for us, but we also need big swings that have customers saying ‘Wow, I can’t believe that just happened’ and will have people telling their friends.” While the jury’s still out on how this will translate to our screens, the emphasis on commercially viable content is undeniable.

Live sports take center stage

The winds of change are also blowing towards live sports. Industry leaders see them as a key draw, and bidding wars for these rights are expected to intensify. “The appeal of live sports is both unique and twofold: They attract new streaming subscribers and reduce churn since viewers want to watch sports live. It is also a big draw for advertisers as streaming services look to grow their ad businesses. It may not be an overstatement (…) to say that a streaming service can’t survive as a stand-alone business without sports,” wrote the NYT.

Who will survive?

With that new landscape, consolidation and bundling are on the horizon. There is a consensus among the executives that streamers need at least 200 million subscribers to be big enough to compete. “There will be only three or four streaming survivors: Netflix and Amazon, almost certainly. Probably some combination of Disney and Hulu. Apple remains a niche participant, but appears to be feeling its way into a long-term, albeit money-losing, presence, which it can afford to do. That leaves big question marks over Peacock, Warner Bros. Discovery’s Max, and Paramount+,” explains the NYT.

A familiar future?

While some of these changes may be positive, a sense of déjà vu lingers. In essence, the future of streaming, as envisioned by these executives, may offer a different set of players, but the overall experience might feel like a new coat of paint on the same old TV.

À lire plus tard

Vous devez être inscrit pour ajouter cet article à votre liste de lecture

S'inscrire Déjà inscrit ? Connectez-vous